経営者のための会計税務解説 第6回

13 Sep 2017経営者のための会計税務解説 第7回

経営者のための会計税務解説

日比租税条約適用の基本と最新動向、および留意点-親会社のフィリピンでの所得に関して二重課税を回避するために

P&A グラントソントン Japan Desk Director 伏見 将一

日本親会社に対するフィリピンでの所得に対する課税

フィリピンの子会社から日本の親会社に対して、サービスの対価、配当、借入金の利息、商標・知的財産使用によるロイヤルティー、リース資産の賃料などを支払っているケースは多い。当該取引は、日本親会社のフィリピンで発生した所得(フィリピン源泉所得)であるため、フィリピンで課税されることになる。

日本親会社はフィリピンに銀行口座などを保有していないことから直接、内国歳入庁(BIR)に納税することはできない。また、日本の法人であるため、原則、所得については日本で課税されるが、当該フィリピン源泉所得をフィリピンでも課税された場合には、二重課税となってしまう。この部分に関する取り決めについて、以下、解説していく。

フィリピン法人の最終源泉税による納税

日本親会社はフィリピンにおいて非居住外国法人となるため、日本親会社から直接、BIRに納税するのではなく、対価の支払者であるフィリピン子会社が源泉という形で徴収を行い、BIRに納税・申告する方法が取られている。日本親会社は、このフィリピン子会社の源泉徴収の支払いにより、フィリピンの課税・納税が完了したことになる。これを最終源泉税制度という。

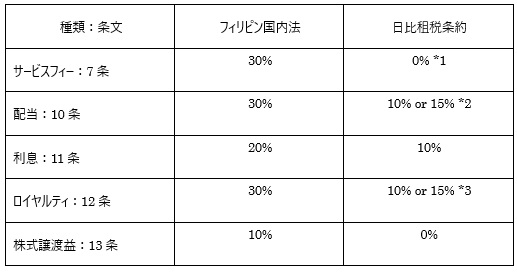

日比租税条約による軽減税率

日本とフィリピンの間では、日比租税条約(日・比租税条約改正議定書:所得に対する租税に関する二重課税の回避および脱税の防止のための日本国とフィリピン共和国との間の条約を改正する議定書)が締結されているため、BIRの定めた日比租税条約申請の手続きを行うことで、軽減税率の適用を受けることができる。また、日本親会社はフィリピンで支払った最終源泉税に対して日本で外国税額控除を適用することによって二重課税を回避することができる。

*1 フィリピンに恒久的施設(PE:Permanent Establishment)を有していない場合(年間で6カ月以上フィリピンにおいて役務提供していない場合)に適用

*2 株式の10%以上を6カ月以上直接保有している場合は10%、それ以外は15%

*3 映画・テレビ・ラジオの使用料は15%、それ以外は10%

一部の取引に関する日比租税条約の申請手続きの簡素化

日比租税条約による軽減税率の適用を受けるためには、BIRが定めた手続きを行う必要がある。この手続きが行われていない場合、BIRは軽減税率の適用を認めていない。

従来、日比租税条約の適用に当たっては、取引の種類にかかわらず、日本法人に関する居住証明書、会社定款(日本語および英語)、特別委任状などの提出が求められ(Revenue Memorandum Order No.72-2010)、これらの書類について、日本において公証、外務省およびフィリピン大使館の認証が必要であり時間と費用がかかっていた。

2017年3月28日にBIRから日比租税条約の申請手続きにおける留意点と租税条約申請手続きに関するルールが発令され(Revenue Memorandum Order No.8-2017)、配当、利息、ロイヤルティー取引に対する租税条約の申請手続きは、2017年6月26日から簡素化された新ルールが適用された。なお、サービスフィーなどの事業所得の支払いについては、従来通り旧ルールでの申請が必要であることに留意が必要である。

この簡素化された新ルールでは、Certificate of Residence for Tax Treaty Relief(CORTT)というフォームに支払者や支払受取者の情報、取引の内容などを記入し、相手国の税務当局の居住性の証明を記載することで、申請ができることとなった。これにより、日本での公証、外務省およびフィリピン大使館の認証が必要であった会社定款(日本語および英語)、特別委任状などは不要となった。

なお、当該新ルールに関しては、ガイドラインが明確となっていない部分もあるため、実務上の運営については、会計事務所などから情報のアップデートを行うことが求められる。

日比租税条約の申請手続きの留意点

上記の旧ルール・新ルールにかかわらず、日比租税条約適用のための手続きにおいては、下記の点に留意する必要がある。

- 事前に申請

-

日比租税条約の申請は事前に行われることが求められている。事前というのは、当該取引の対価を支払う時点または未払い金計上する時点の早い方より前、という意味である。日比租税条約申請を行ってから承認が完了するまでには、BIR内でのプロセスに複数年の時間を要する。このため、承認が事前に完了することは求められておらず、適切な申請が事前に行われていることが求められている。

-

なお、最高裁の判例によると、BIRの定めた事前申請がなかったからといって、必ずしも軽減税率の適用を否定するものではないと解することができる。しかし現時点では、これに関してBIRによる明確なルール変更は行われていないため、引き続き事前申請を行うことが望ましいとされている。従って、日比租税条約の適用が必要な取引が発生する際には、余裕を持ったスケジュールが望まれる。

-

- 取引ごとに申請

-

日比租税条約の手続きは取引ごとに行われることが求められている。例えば、前年度の配当手続きについて、日比租税条約の手続きを行っていたとしても、当年度に配当を行う場合には別途、日比租税条約の手続きが必要となる。そのため、配当や借り入れなど複数回の取引が想定される場合には、細かい金額で複数の取引を発生させるのではなく、ある程度まとまった金額で取引を発生させることで、日比租税条約の手続きの回数を減らすことも考えられる。

-

- 移転価格の文書化

-

ここで想定している取引は日本親会社とフィリピン法人間での取引であり、関連当事者取引に該当するため、原則として移転価格文書の作成・保管が義務付けられ、税務調査の際には当該取引条件の妥当性を示す必要がある。また、日比租税条約申請の際に、BIRから移転価格文書の提出を求められるケースも散見されているため留意が必要である。

-

以上

問合せ、ご相談は:

P&Aジャパンデスク(Japan.Desk@ph.gt.com )まで。